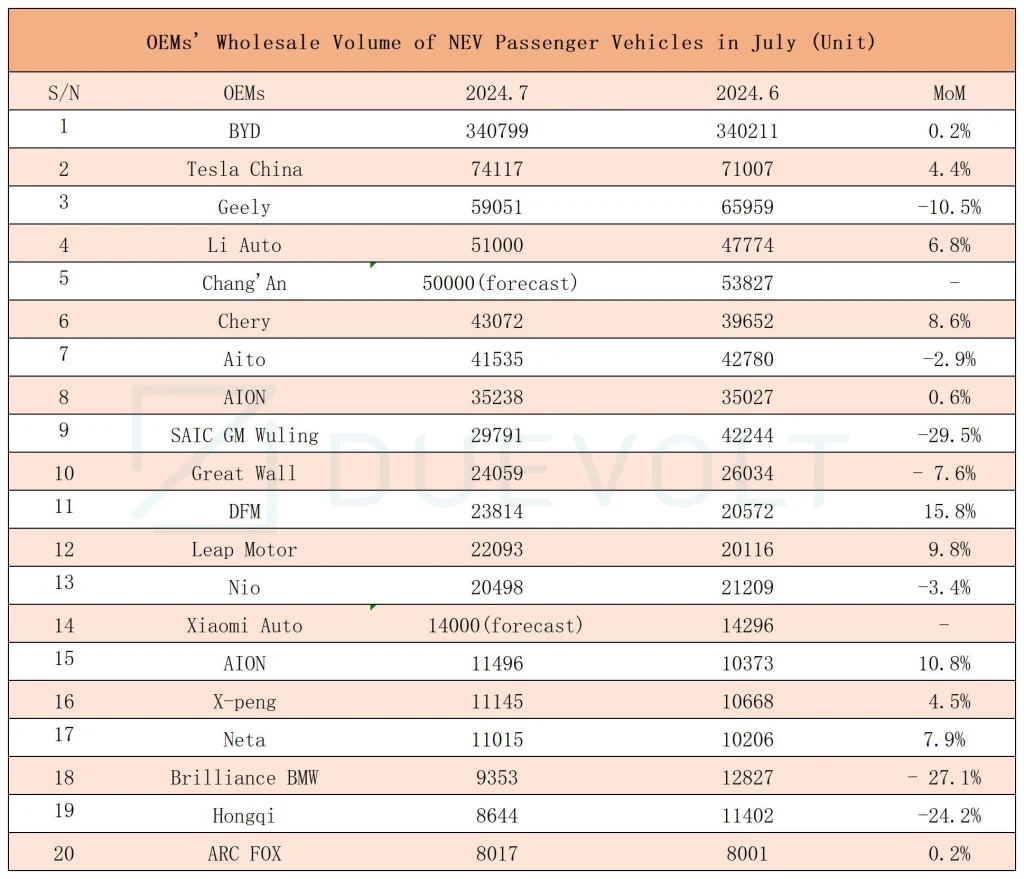

Top 20 OEMs in China NEV Market July 2024

July is traditionally a slow production month for the automotive industry, with the overall market trend being weak. According to data from the China Passenger Car Association (CPCA), the estimated wholesale sales of new energy passenger vehicles nationwide in July reached 950,000 units, a year-on-year increase of 29%, but a month-on-month decline of 3%.

In the Top 20 NEV OEMs list, the newly launched Qin L DM-i, Seagull 06, and Song L DM-i helped BYD’s sales surpass 340,000 units once again, setting a new record and firmly maintaining its position as the top-selling automaker in China.

Aside from BYD, Chery, Li Auto, and Arcfox also reached new highs. Li Auto, in fourth place, surpassed 50,000 units in sales again, setting a new record, largely thanks to the Li Auto L6. Chery, in sixth place, exceeded 40,000 units in sales for the first time. Arcfox, for the second consecutive month, surpassed 8,000 units, with July sales slightly increasing by 0.2% to 8,017 units, marking its first entry into the top 20 sales list for Chinese passenger vehicle manufacturers.

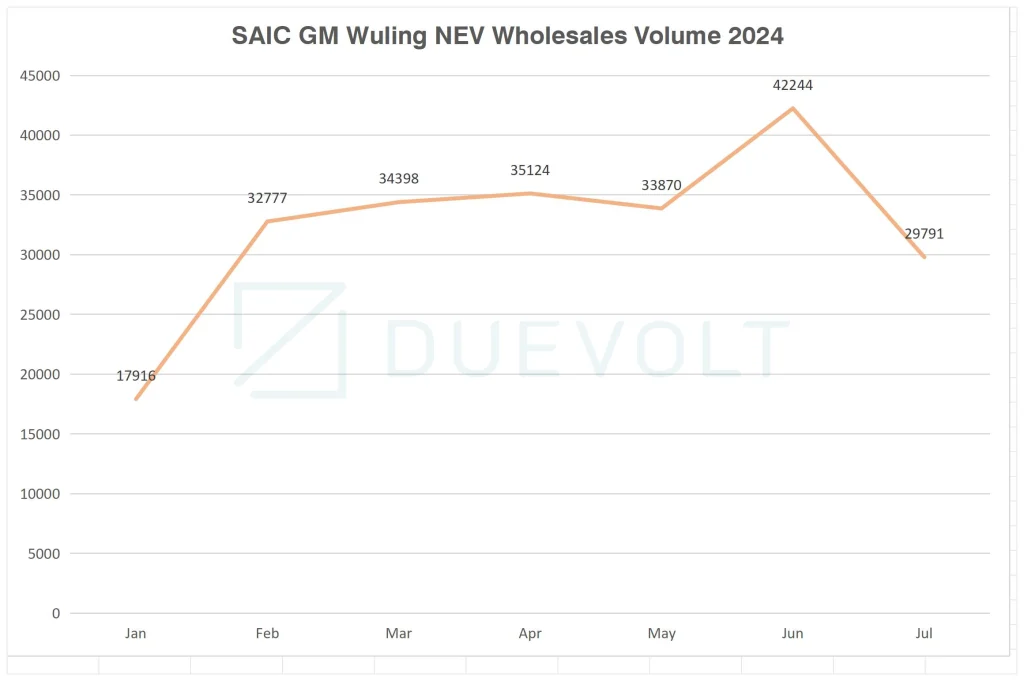

On the contrary, nearly 40% of the automakers in the Top 20 list experienced a month-on-month decline in sales. Notably, SAIC-GM-Wuling, BMW Brilliance, and FAW Hongqi saw their sales drop by more than 20% month-on-month. SAIC-GM-Wuling’s sales fell below 30,000 units again, dropping nearly 30% month-on-month and slipping to ninth place. If this decline continues, their sales may fall out of the top ten in August.

BYD, Chery, and Li Auto Set New Records

BYD’s sales in July exceeded 340,000 units, reaching 340,799 units, a month-on-month increase of 0.2% and a year-on-year increase of 30.5%. This marks a new record for the second consecutive month, solidifying BYD’s position as the sales champion in China’s automotive market. The cumulative sales for 2024 reached 1,947,944 units, including 130,000 pure electric vehicles and 210,000 plug-in hybrid electric vehicles, with over 30,000 units exported.

For specific models, the Qin family (including Qin PLUS and Qin L) broke through 70,000 units for the first time, reaching 73,541 units, with the recently launched Qin L DM-i contributing significantly. Its sales jumped from 20,100 units in June to 32,941 units in July, making it BYD’s strongest card.

The Han family sold 18,053 units, the Tang family 12,056 units, and the Song family (including Song L, Song Pro DM-i, and Song L DM-i) sold 28,328 units. The newly launched Song L DM-i is still ramping up production, and the Song family’s sales are expected to see a significant increase in August. The Yuan family (including Yuan UP and Yuan PLUS) sold 40,952 units.

In the Ocean Net lineup, Seagull and Song PLUS each sold over 36,000 units, and Seal sales exceeded 30,000 units for the first time, with the Seal 06 DM-i accounting for more than 25,000 units, or 73.5% of the total Seal sales.

Looking ahead, as BYD’s products gradually transition to the fifth-generation DM technology and the second-generation blade battery, the company’s product strength will be further enhanced, with a single-month sales breakthrough of 350,000 units expected to be achieved within this year.

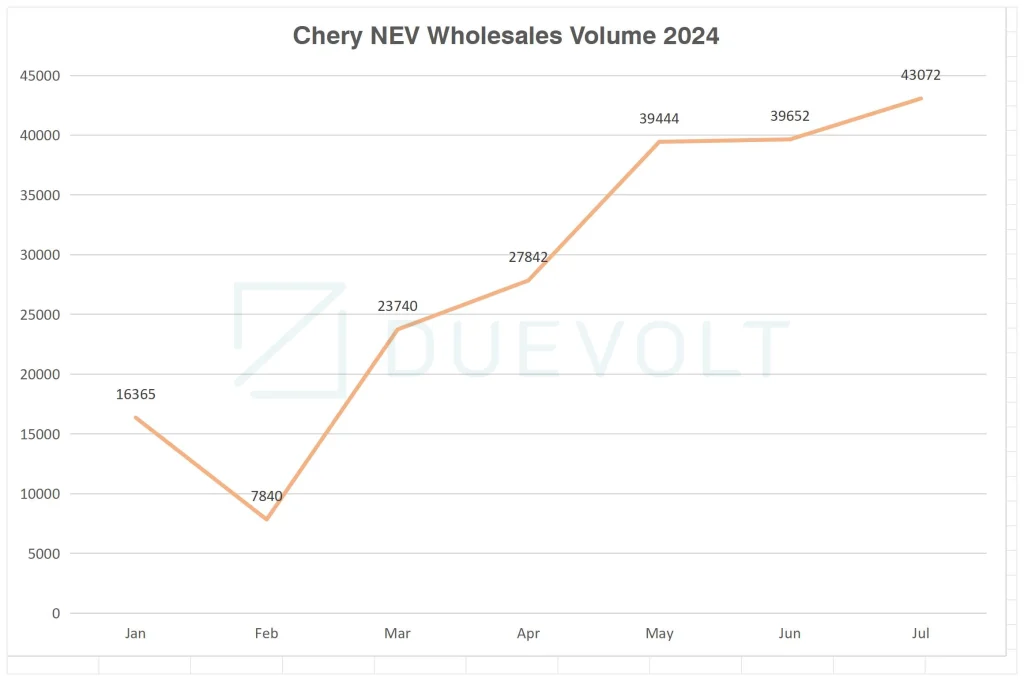

In addition to BYD, Chery, Li Auto, and Arcfox also reached new records. Chery’s July sales increased by 8.6% month-on-month, exceeding 40,000 units for the first time, reaching 43,072 units, ranking sixth. Contributions came from the ICAR brand, EXEED brand’s ES, Chery’s Fengyun, and JETOUR’s Shanhai models.

Additionally, in July, the new EXEED ES launched its 2025 and international versions, and the long-range flagship electric hybrid SUV, Fengyun T10, was launched, all contributing to Chery’s record sales.

Li Auto’s sales surpassed 50,000 units again, setting a new record.

Wuling, BMW, and Hongqi witness Over 20% Month-on-Month Declines

In the Top 20 automakers list, Wuling, BMW, Hongqi, Geely, AITO, NIO, and Great Wall all experienced month-on-month declines in sales. Notably, Wuling, BMW, and Hongqi saw their sales drop by more than 20%.

Wuling’s sales fell below 30,000 units again, dropping nearly 30% month-on-month, and fell to ninth place. The Wuling Starlight sold 6,842 units, a month-on-month decline of 45%; the Bingo family sold 15,949 units, a 9.9% month-on-month increase; and the Hongguang MINIEV family sold 15,769 units, a 23% month-on-month increase.

The main reason for the sharp decline in Wuling’s NEV sales was the significant drop in Starlight’s sales.

Brilliance BMW’s July sales fell below 10,000 units, a 27% month-on-month decline. The main reason for BMW’s sales decline was the company’s decision to reduce sales volume to stabilize prices and alleviate the pressure on store operations starting in July.

Due to a sharp decline in E-QM5 sales, FAW Hongqi’s July sales fell below 10,000 units again, a 24% month-on-month decline, ranking 19th.

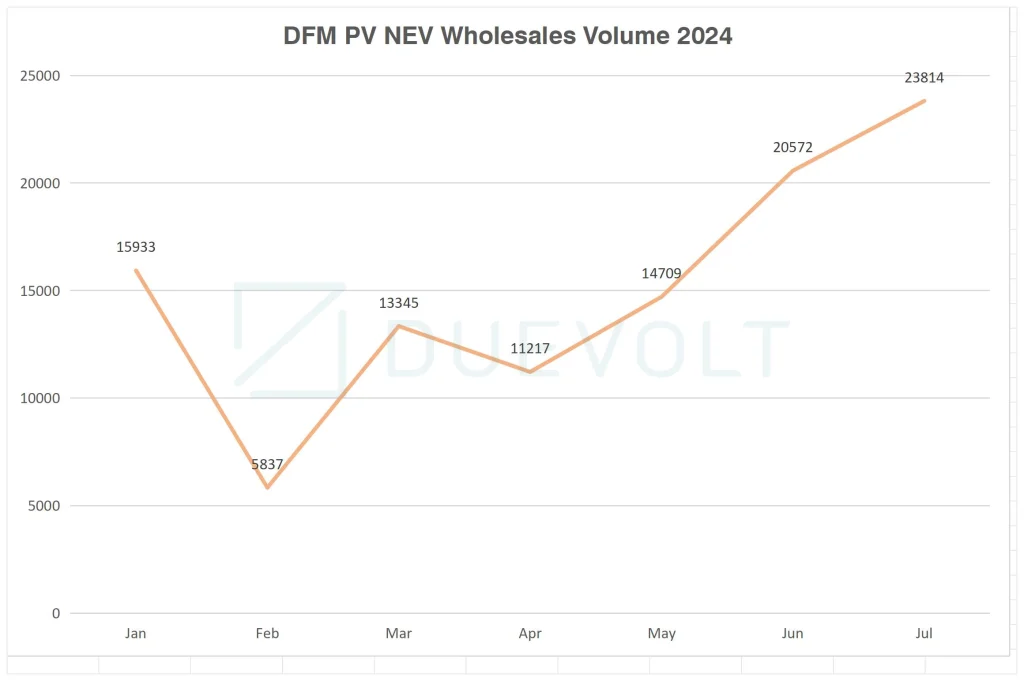

DFM Passenger Vehicle and SAIC Volkswagen have Over 10% Month-on-Month Increases

Conversely, Dongfeng Passenger Vehicle, SAIC Volkswagen, Leapmotor, XPeng, Neta, Li Auto, Arcfox, AION, Tesla, and Chery all saw month-on-month increases in sales, with Dongfeng Passenger Vehicle and SAIC Volkswagen achieving over 10% increases.

Dongfeng Passenger Vehicle’s sales surpassed 20,000 units again, reaching 23,814 units, a 15.8% month-on-month increase, ranking 11th on the list. The Dongfeng Yixian sold 6,329 units, with a cumulative sales volume of 23,157 units this year, achieving accelerated sales, with significant contributions from the Yixian 007 and 008 models launched this year.

With the launch and delivery of the extended-range version of the eπ007 sedan on August 9, Dongfeng Yixian’s sales are expected to reach new heights.

SAIC Volkswagen sold 11,496 units, a 10.8% month-on-month increase, rising three places to 15th. On July 31, SAIC Volkswagen launched new versions of the ID.3 and ID.4 X. The ID.3 is priced starting at 119,900 RMB for a limited time, and the ID.4 X is priced starting at 149,900 RMB, with discounts of up to 60,000 RMB and a gift package worth 5,088 RMB for purchases made before September 30.

The substantial price reductions and added features demonstrate a sincere effort, with positive feedback reflected in SAIC Volkswagen’s July sales. As production capacity continues to ramp up, their August sales are expected to see further growth.