Europe Auto Market Overview for Jul 2024 is freshly released, following Duevolt New Energy’s compilation and release of Europe Auto Market Overview for June and H1 2024 in July,! Duevolt continues to provide the latest automotive industry data for car enthusiasts, industry professionals, and automotive media.

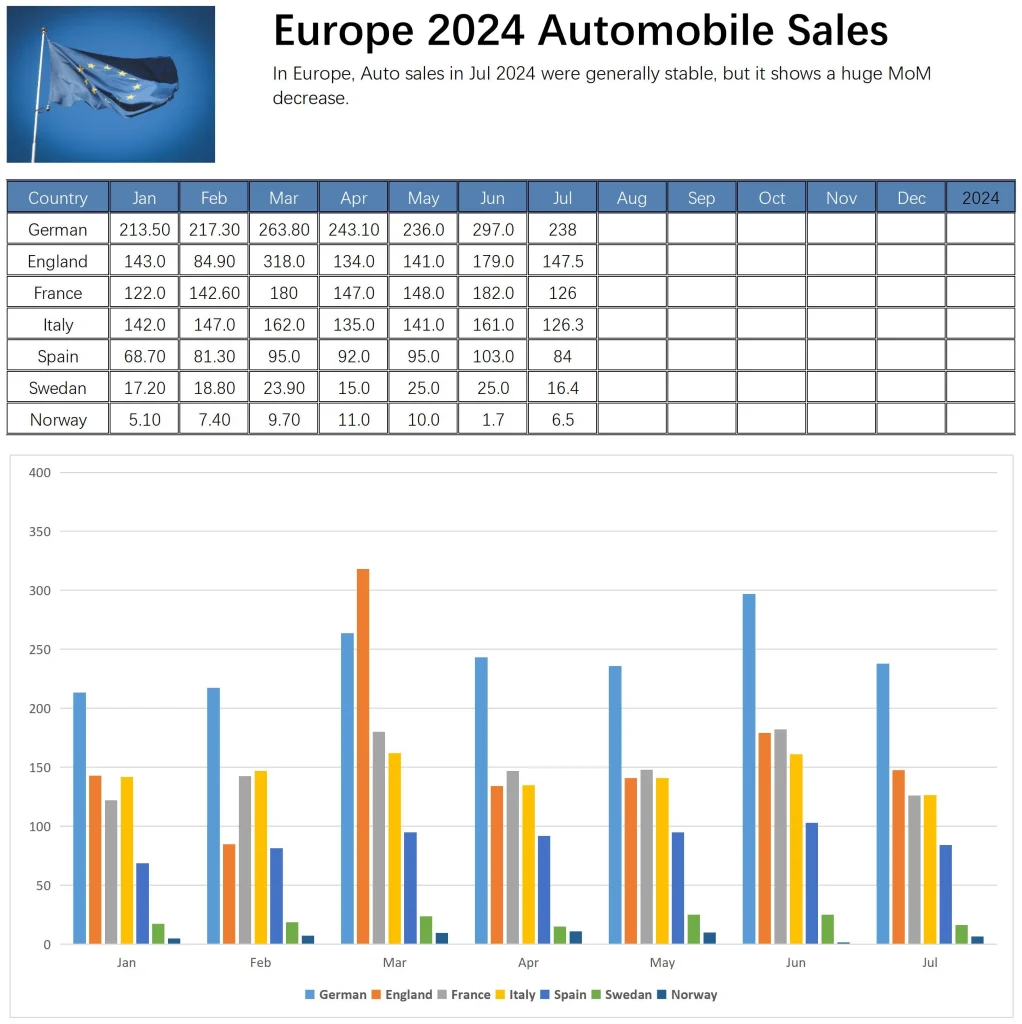

Below is a summary of the car sales data from several major European automotive markets for July 2024:

● Germany continued to lead the sales charts with 238,000 vehicles sold in July, bringing the total sales for the year to 1.7087 million units.

● The UK followed closely, with July sales reaching 147,500 vehicles, and cumulative sales for the first seven months of the year totaling 1.1474 million units.

● France saw sales of 126,000 vehicles in July, with cumulative sales for the year reaching 1.0476 million units.

● Italy also showed steady growth, with July sales of 126,300 vehicles and a cumulative total of 1.0143 million units.

● Spain, although a smaller market, achieved solid growth with 84,000 vehicles sold in July, bringing the cumulative total to 619,000 units.

● Sweden, an important market in Northern Europe, recorded July sales of 16,400 vehicles, with cumulative sales reaching 141,300 units.

● Norway, despite its smaller scale, is notable for its high acceptance of electric vehicles, with July sales at 6,500 vehicles, bringing the total sales for the year to 66,700 units.

Duevolt New Energy Comments: Although the major European markets performed relatively better compared to 2023, overall car consumption remains relatively weak.

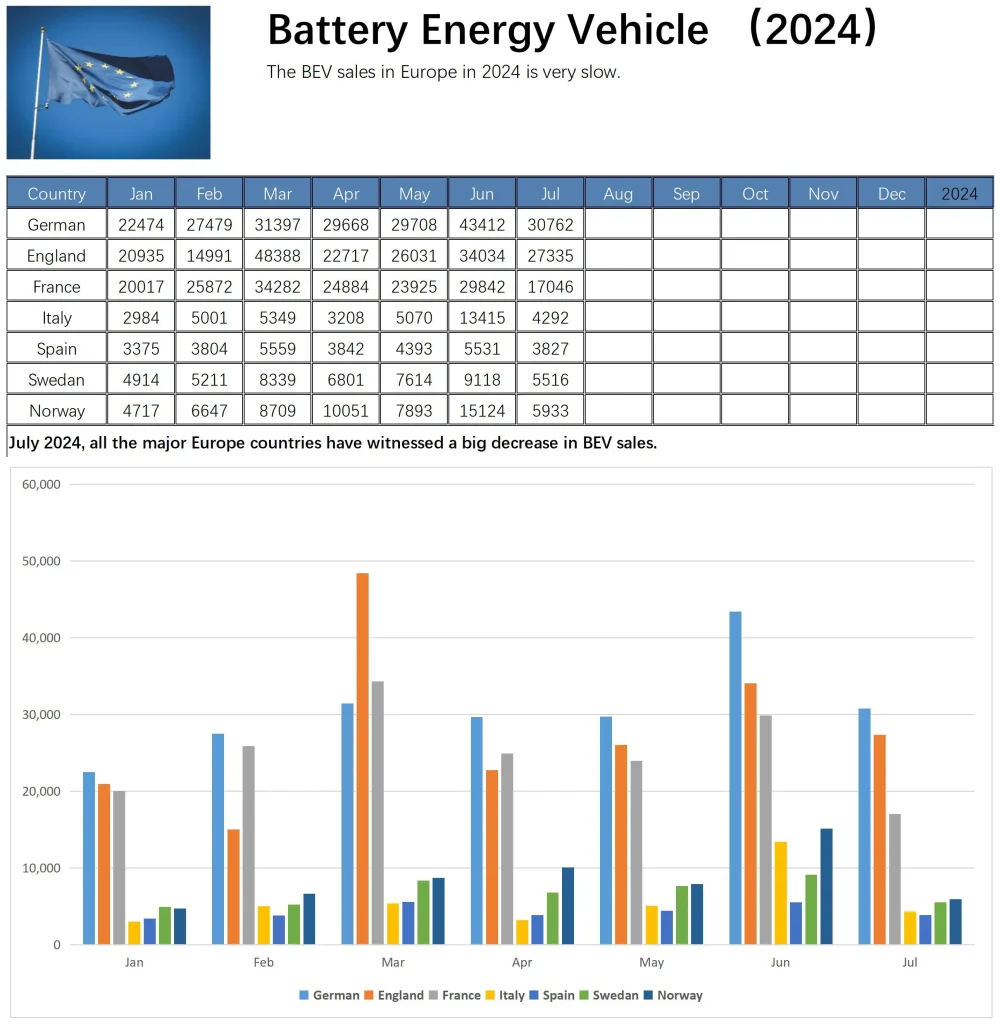

Battery Electric Vehicle Sales:

● Germany: In July, sales reached 30,762 units, a sharp year-on-year drop of 36.8%, with cumulative sales for the year at 214,900 units. The decline has been rapid following the reduction of subsidies.

● UK: July sales were 27,335 units, with cumulative sales from January to July totaling 194,431 units. The UK’s electric car market has performed relatively well even without subsidies.

● France: July sales were 17,046 units, with cumulative sales for the year at 175,868 units. Despite subsidies, the electric car market in France remains lukewarm.

● Italy: July sales were 4,292 units, with cumulative sales for the year at 39,319 units. Sales in Italy have been relatively low in recent months.

● Spain: July sales were 3,827 units, with cumulative sales for the year at 30,331 units. The level of electric car sales remains relatively low.

● Sweden: July sales were 5,516 units, with cumulative sales for the year at 47,513 units. The Swedish market’s performance has been moderate.

● Norway: July sales were 5,933 units, with cumulative sales for the year at 59,074 units. The overall market in Norway is average.

Duevolt New Energy Comments: Battery electric vehicles do not have an advantage in this year’s European market.

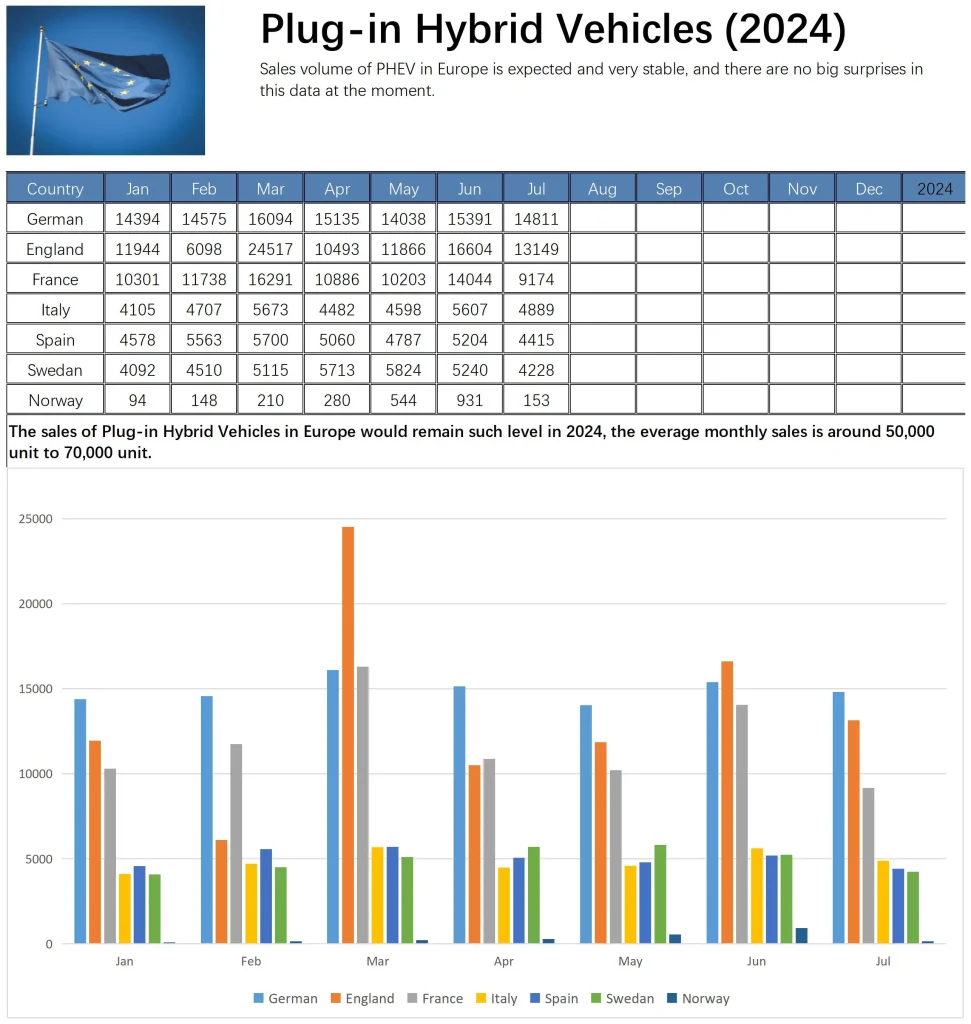

Plug-in Hybrid Sales:

● Germany: July sales were 14,811 units, with cumulative sales for the year at 104,438 units.

● UK: July sales were 13,149 units, with cumulative sales for the year at 94,671 units.

● France: July sales were 9,174 units, with cumulative sales for the year at 82,637 units.

● Italy: July sales were 4,889 units, with cumulative sales for the year at 34,061 units.

● Spain: July sales were 4,415 units, with cumulative sales for the year at 35,307 units.

● Sweden: July sales were 4,228 units, with cumulative sales for the year at 34,722 units.

● Norway: July sales were just 153 units, with cumulative sales for the year at 2,360 units.

Overall Comparison:

● July Sales Data: The UK and Germany performed relatively well, France, Italy, Spain, and Sweden are in the middle tier, and Norway is far behind.

● Cumulative Sales from January to July: Germany and the UK lead by a large margin, followed by France, then Italy, Spain, and Sweden, with Norway lagging significantly.

Duevolt New Energy Comments: Plug-in hybrids in Europe remain relatively weak, with considerations for CO2 emissions and complex charging infrastructure.

Conclusion:

Overall, the sales growth of pure electric vehicles and plug-in hybrids in Europe is at average level, and the growth rate is starting to slow down.