Europe BEV Sales Volume for Aug 2024

Europe Auto Market Overview for Aug 2024 is finally been organized and gonna disclosed in our below content. Continuing to our monthly report upon Europe Auto market in July, now we gonna release and shortly analyze the auto sales volume in Europe in Aug 2024. the EV sales volume in August 2024 Sees a Collapse in European.

In August 2024, the European auto market faced a significant downturn, particularly in Germany and France, where sales plummeted by about a quarter.

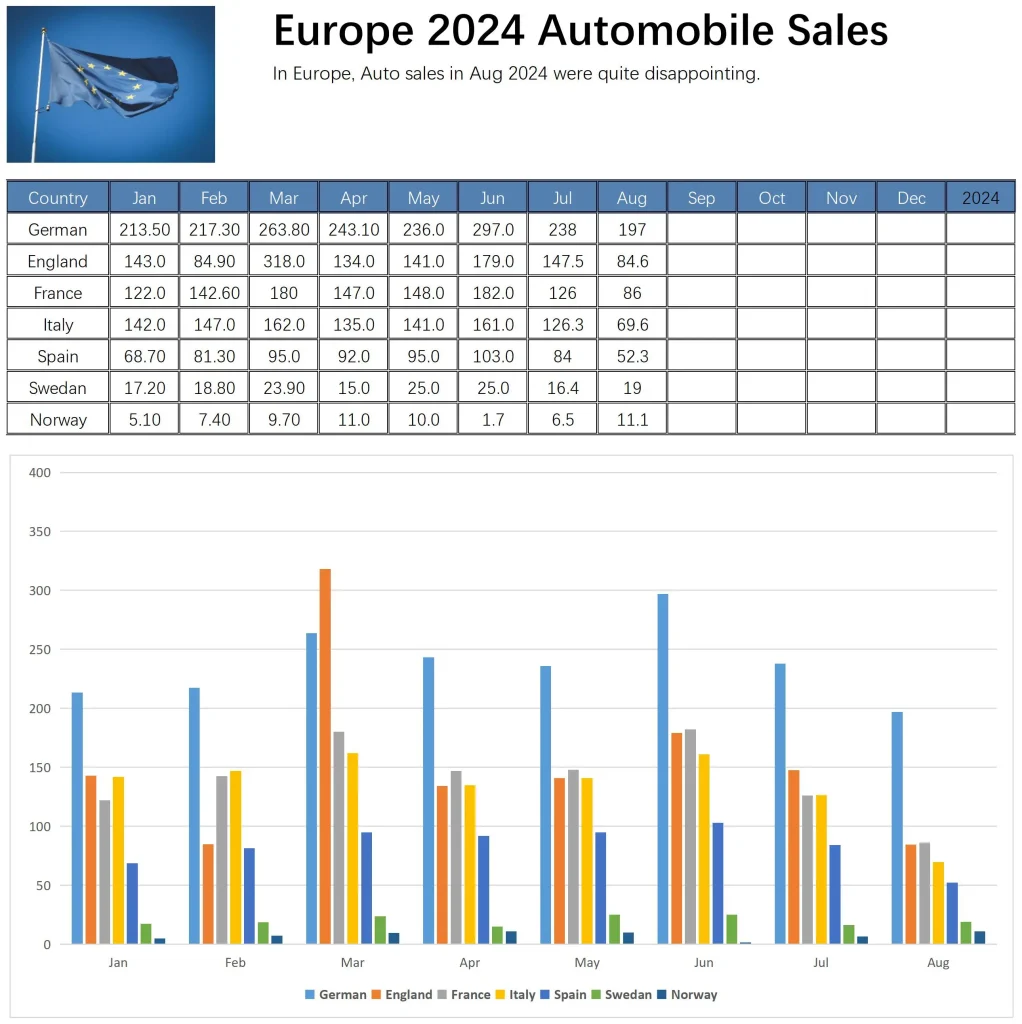

A brief overview of auto sales in major European countries is as follows:

- Germany: August sales stood at 197,000 units, a YoY decrease of 27.8%, with a cumulative sales volume of 1,905,700 units.

- United Kingdom: August sales were 84,600 units, a YoY decrease of 1.3%, with a cumulative sales volume of 1,232,000 units.

- France: August sales were 86,000 units, a YoY decrease of 24.3%, with a cumulative sales volume of 1,133,600 units.

- Italy: August sales were 69,600 units, a YoY decrease of 13.4%, with a cumulative sales volume of 1,083,900 units.

- Spain: August sales were 52,300 units, a YoY decrease of 6.5%, with a cumulative sales volume of 671,300 units.

- Sweden: August sales were 19,000 units, with a cumulative sales volume of 160,300 units.

- Norway: August sales were 11,100 units, with a cumulative sales volume of 77,800 units.

The significant drop in the major European auto markets has made the YoY sales figures look very poor, far from the peak levels seen before 2019.

1. New Energy Vehicle Sales

BEV Sales Volume Aug 2024

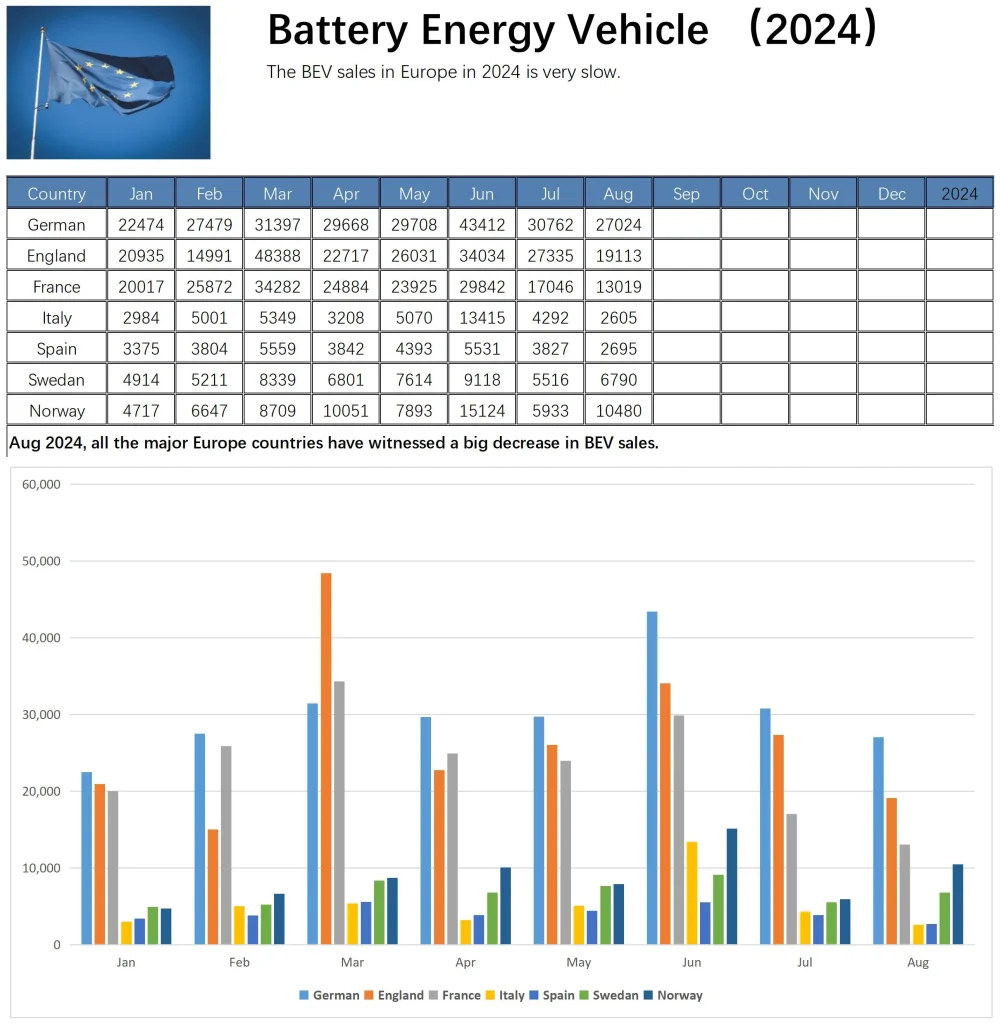

In August 2024, the sales of BEVs in major European countries were as follows:

- Germany: August BEV sales were 27,024 units, a staggering YoY decrease of 68.8%, with a cumulative sales volume of 241,924 units.

- United Kingdom: August BEV sales were 19,113 units, a YoY increase of 10.8%, with a cumulative sales volume of 213,544 units.

- France: August BEV sales were 13,109 units, with a cumulative sales volume of 188,977 units.

- Italy: August BEV sales were 2,605 units, a YoY decrease of 36.1%, with a cumulative sales volume of 41,924 units.

- Spain: August BEV sales were 2,696 units, with a cumulative sales volume of 33,027 units.

- Sweden: August BEV sales were 6,790 units, with a cumulative sales volume of 47,520 units.

- Norway: August BEV sales were 10,480 units, with a cumulative sales volume of 69,554 units.

The substantial decline in Germany’s BEV sales indicates a lack of demand for BEVs in Europe, which could dampen the motivation for European automakers to develop BEVs.

PHEV Sales Volume Aug 2024

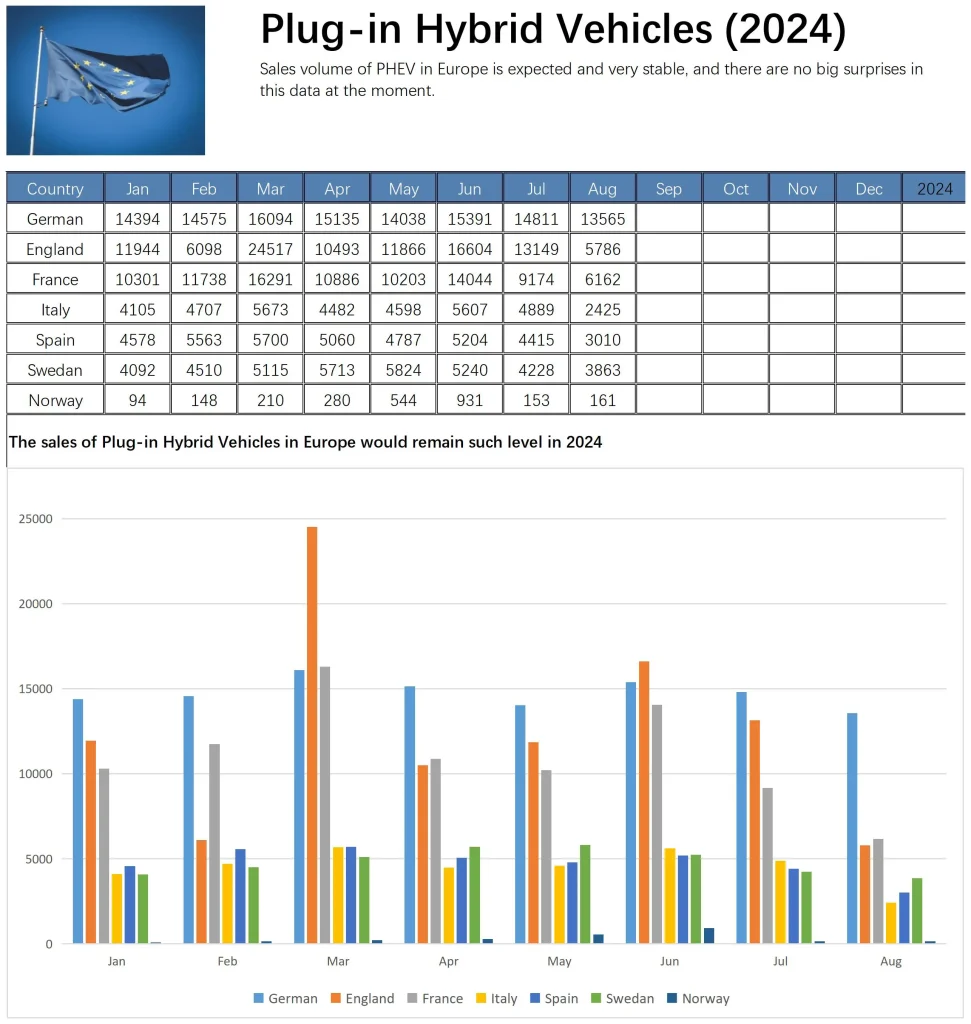

- Germany: August PHEV sales were 13,565 units, a YoY decrease of 6.8% (a more acceptable drop), with a cumulative sales volume of 118,003 units.

- United Kingdom: August PHEV sales were 5,786 units, a YoY decrease of 12.3%, with a cumulative sales volume of 100,457 units.

- France: August PHEV sales were 6,162 units, with a cumulative sales volume of 88,799 units.

- Italy: August PHEV sales were 2,425 units, a YoY decrease of 28.2%, with a cumulative sales volume of 36,486 units.

- Spain: August PHEV sales were 3,010 units, with a cumulative sales volume of 38,317 units.

- Sweden: August PHEV sales were 3,863 units, with a cumulative sales volume of 38,585 units.

- Norway: August PHEV sales were just 161 units (indeed very low), with a cumulative sales volume of 2,521 units.

The PHEV market in Europe was never large, and with a slight decrease, it seems challenging to expand this market further.

2. European Sales and Automaker Assessments

Volkswagen has defended its unprecedented plan to consider closing German factories, stating that the slump in auto sales has left the company with about two factories’ worth of excess capacity.

Since the outbreak of the pandemic, demand in Europe has not recovered, with the region’s industry-wide auto deliveries about 2 million units short of the peak. Volkswagen alone has seen a loss of about 500,000 units, equivalent to the capacity of two factories.

Volkswagen is contemplating whether to close German factories for the first time and terminate work guarantee agreements, having long ignored the issues of overcapacity and declining competitiveness. With a sluggish transition to electric vehicles and slowing consumer spending, Volkswagen’s profit margins are being squeezed, and European automakers also face competition from Tesla and Chinese car brands.

Volvo Cars has announced that it will no longer insist on its target of full electrification by 2030 and expects to include some hybrid models in its product lineup. By 2030, 90% to 100% of the company’s sales are expected to be BEVs or PHEVs, with 10% being mild hybrids.

It is evident that with the visibly weakening demand for electric vehicles in Europe, the strategies of European automakers indeed need to become more conservative.