Europe Auto Market Overview for Sept 2024 -EV Sales Decline and Tariff Impacts

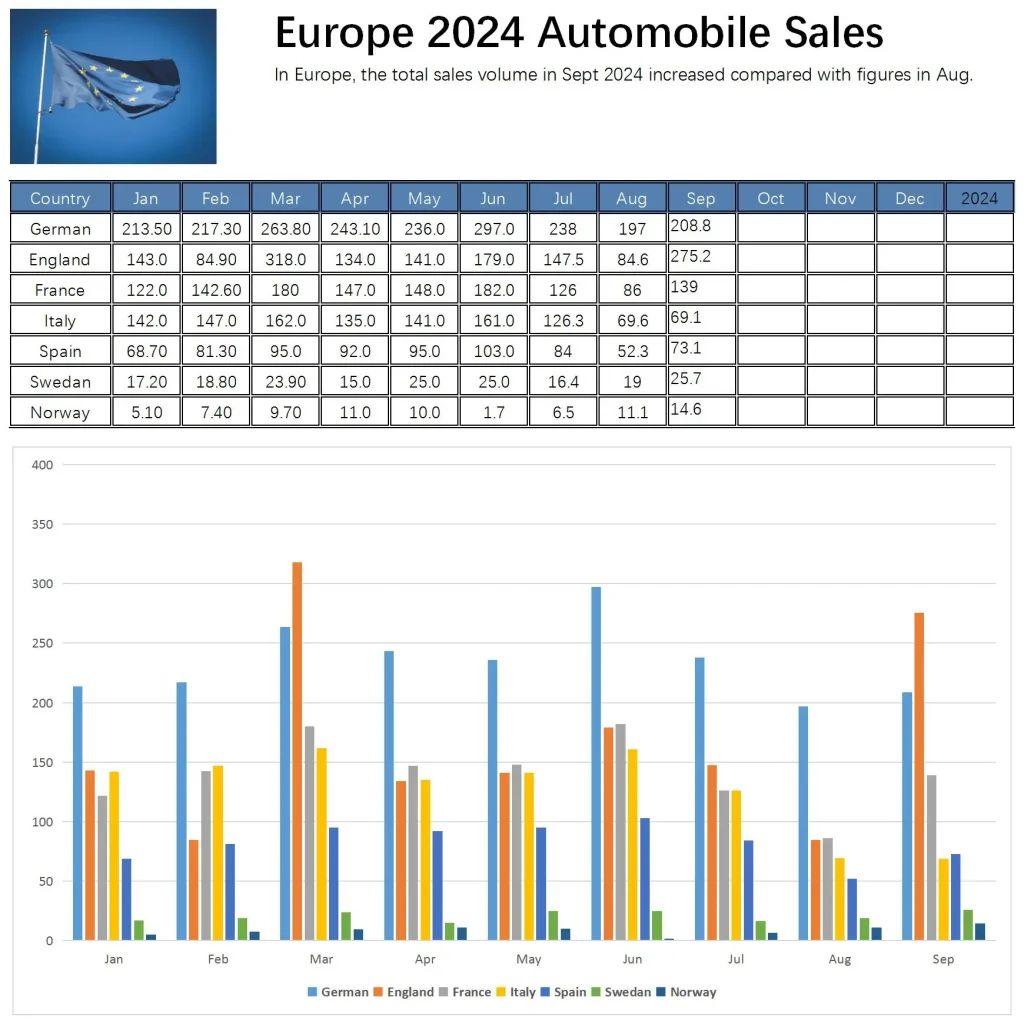

The Europe Auto Market Overview for Sept 2024 is organized and released by Duevolt team for your information. In Sept 2024, European auto sales across major markets continued to slow compared with sales datas in aug 2024, with lower numbers compared to pre-pandemic highs. The automotive market is facing pressure, particularly for battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), as well as from new tariff policies affecting Chinese imports.

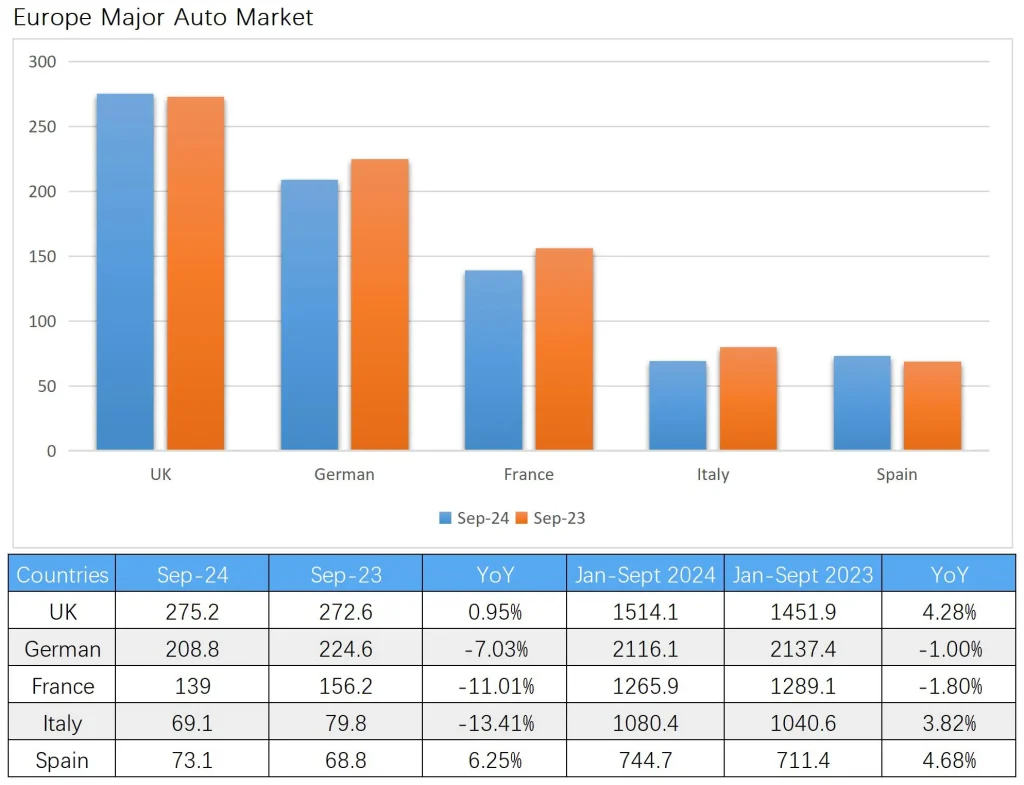

1. Sales Situation in Major Countries Battery Electric Vehicles (BEV)

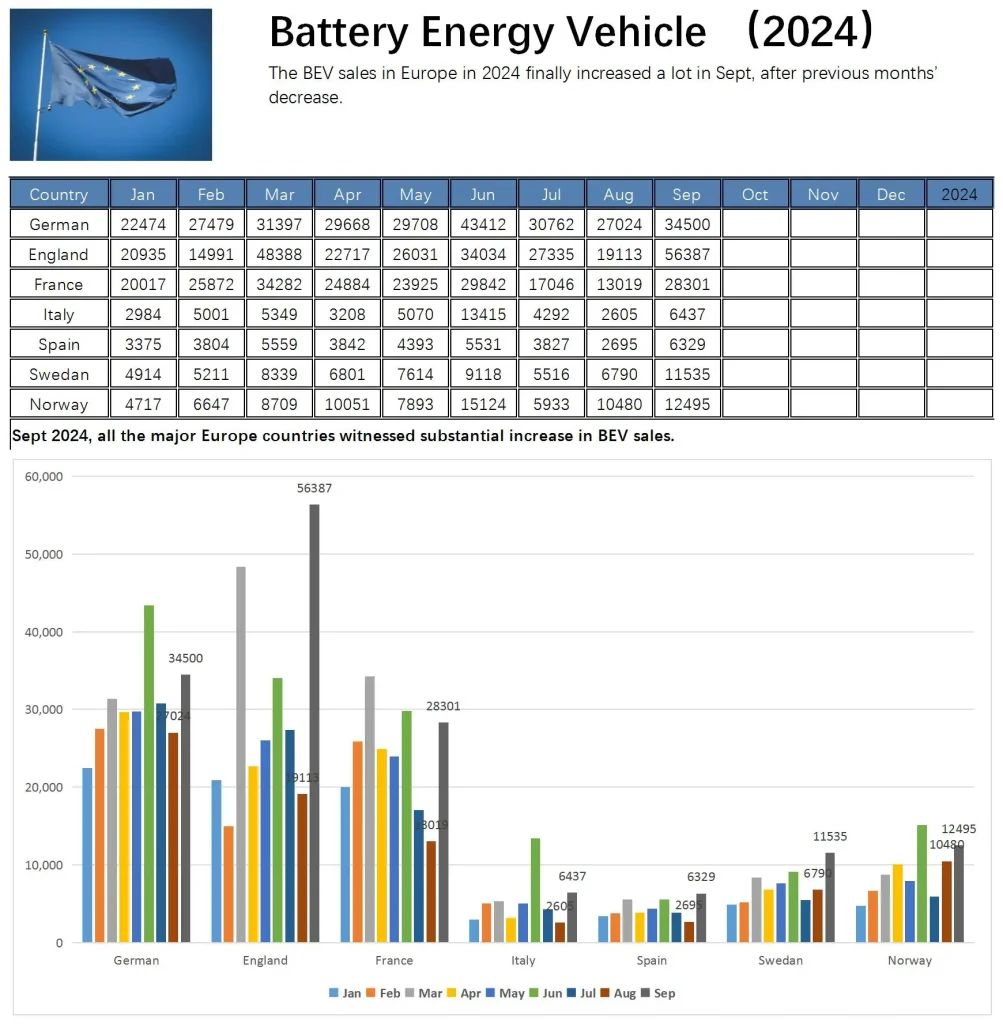

Battery Electric Vehicles (BEVs):

· Germany: 34,500 units sold in September, bringing the year-to-date total to 276,424 units, with a market penetration of 16.52%.

· United Kingdom: 56,387 units sold, reaching a cumulative total of 269,931 units, with a 20.49% market penetration rate.

· France: 28,301 units sold, year-to-date total 217,278 units, with a penetration rate of 20.36%.

· Norway: 12,495 units sold, cumulative sales reaching 82,049 units, achieving one of the highest penetration rates at 85.58%.

Commentary: The BEV market in Europe is seeing mixed results, with strong adoption in certain countries like Norway, while Germany’s BEV demand remains relatively low.

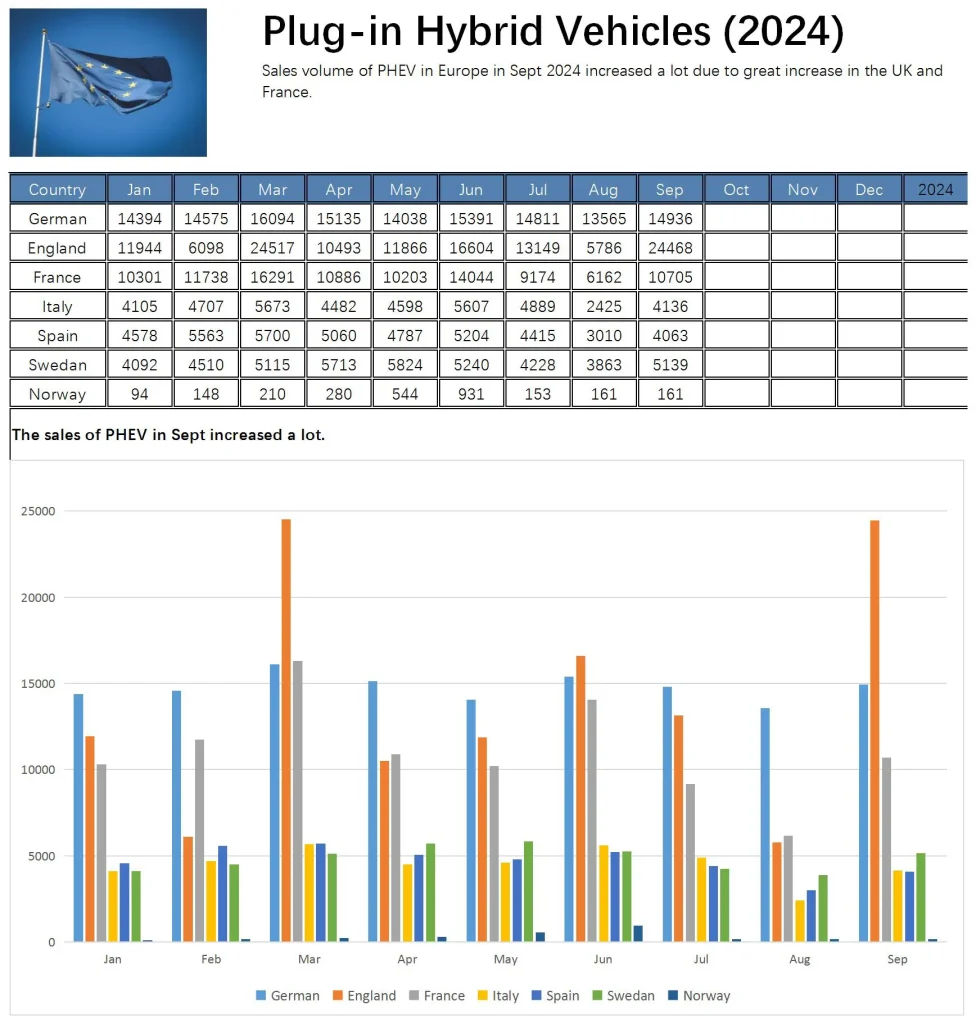

Plug-in Hybrid Electric Vehicles (PHEVs):

· Germany: 14,936 units sold in September, year-to-date total of 132,939 units, with a 7.15% market penetration rate.

· United Kingdom: 24,468 units sold, bringing the cumulative total to 124,925 units, at an 8.89% market penetration rate.

· France: 10,705 units sold, cumulative total 99,504 units, market penetration at 7.70%.

· Sweden: 5,139 units sold, cumulative total 43,724 units, achieving a high penetration of 20.00%.

Commentary: PHEVs continue to struggle for market share compared to BEVs. While there’s growth in countries like the UK, other markets lag significantly.

2. European Tariff Policy on China

Adding to the market’s complexity, the European Union voted to implement an additional 35% surcharge on the existing 10% tariff for Chinese EV imports, set to take effect at the end of October. This measure effectively raises the total tariff on Chinese EVs entering the European market to 45%, aiming to protect local manufacturers from increasing competition from Chinese brands.

Major Chinese automakers, including Tesla, BYD, Geely, and SAIC, are expected to face significant cost increases, affecting their competitiveness in Europe. For instance, Tesla will see a combined tariff of 7.8% on its Chinese-made models, while BYD faces a 17% tariff and Geely a 18.8% tariff. SAIC is the hardest hit, with a combined tariff of 35.3%. Other Chinese automakers not specifically sampled face an average rate of 20.7%.

Industry Reactions and Potential Impacts:

European manufacturers have voiced concerns over the tariff decision, seeing it as a potential threat to the free trade principles that the EU typically upholds. Geely Holding Group expressed disappointment, suggesting the tariffs could disrupt economic relations between China and Europe. Mercedes-Benz issued a similar response, urging the EU to seek alternative solutions that would encourage growth through free trade. BMW emphasized that limiting the flow of Chinese-made EVs could hinder Europe’s low-carbon goals and delay progress in sustainable transport. Volkswagen and SEAT echoed these concerns, warning that such tariffs could lead to supply chain disruptions and hurt the European automotive industry’s long-term stability.

Conclusion

September’s European auto sales reflect a challenging landscape for both BEVs and PHEVs, with slowing growth and significant variations across countries. Germany and the UK continue to lead in BEV and PHEV sales volumes, but markets like Norway and Sweden show the highest penetration rates, highlighting a diverse range of adoption levels within Europe. The introduction of a 45% tariff on Chinese EV imports has further complicated the market outlook, with European automakers expressing concerns that these tariffs could stifle market competition and ultimately slow the region’s transition to electric mobility.

As Europe grapples with its EV market’s development and the pressures of the new tariff policy on Chinese imports, the coming months will be crucial for determining how both local and foreign automakers navigate this shifting landscape.

We’d continue on tracking more valuable data for the market for your information, and you are always welcomed to share your data and opinion with us.