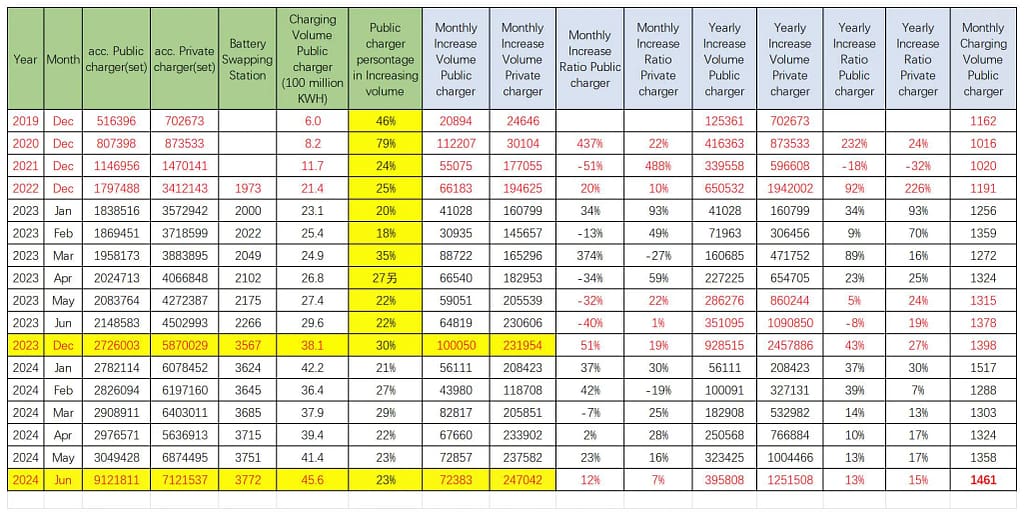

According to data from the China Charging Alliance compiled by the China Passenger Car Association, the number of public EV charging stations in June 2024 increased by 72,300 compared to the previous month, a 12% faster growth rate compared to the same period last year. The annual cumulative increase in public ev charging stations was 400,000, achieving a 13% growth rate compared to the same period last year. Home ev charging stations accompanying vehicles increased by 247,000 compared to the previous month, a 7% faster growth rate compared to June 2023. The annual cumulative increase in home ev charging stations was 1.25 million, a 15% growth rate compared to the same period last year. The total public ev charging volume was 456,000 kWh, showing a good growth rate compared to the same period last year, with an average monthly ev charging volume of 1,461 kWh per station, a 6% increase compared to June last year.

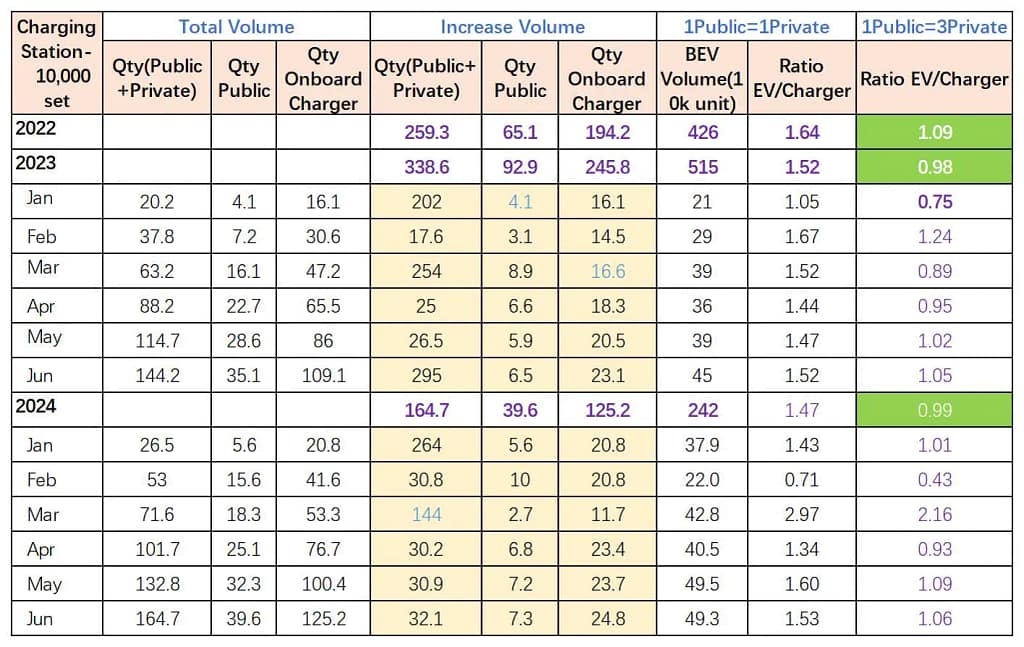

In recent years, China’s ev charging infrastructure has rapidly developed, establishing the world’s largest, most extensive, and most diverse ev charging infrastructure system. Currently, with the estimation of one public ev charging station equating to three home ev charging stations, the vehicle-to-charging station ratio for China’s pure electric vehicle incremental market in 2024 has reached 1:1, significantly leading other countries by several multiples.

However, the current ev charging infrastructure still faces issues such as incomplete layout, unreasonable structure, outdated technology of old ev charging stations, unbalanced services, and non-standardized operations that urgently need improvement. There is a noticeable increase in buyer remorse for electric vehicles in lower-tier regions. As the scale continues to expand, the adjustment difficulties will decrease, and the potential for electric vehicle enhancement will increase.

The result of moderate ahead-of-schedule development of ev charging stations is underutilization, leading to overall losses in charging facility operations. Currently, the simple calculation ratio of pure electric passenger cars to the incremental public ev charging stations is 1.4:1. If at least three cars are served by one public ev charging station, the charging system for pure electric passenger cars essentially maintains a 1:1 ratio, which is relatively optimal.

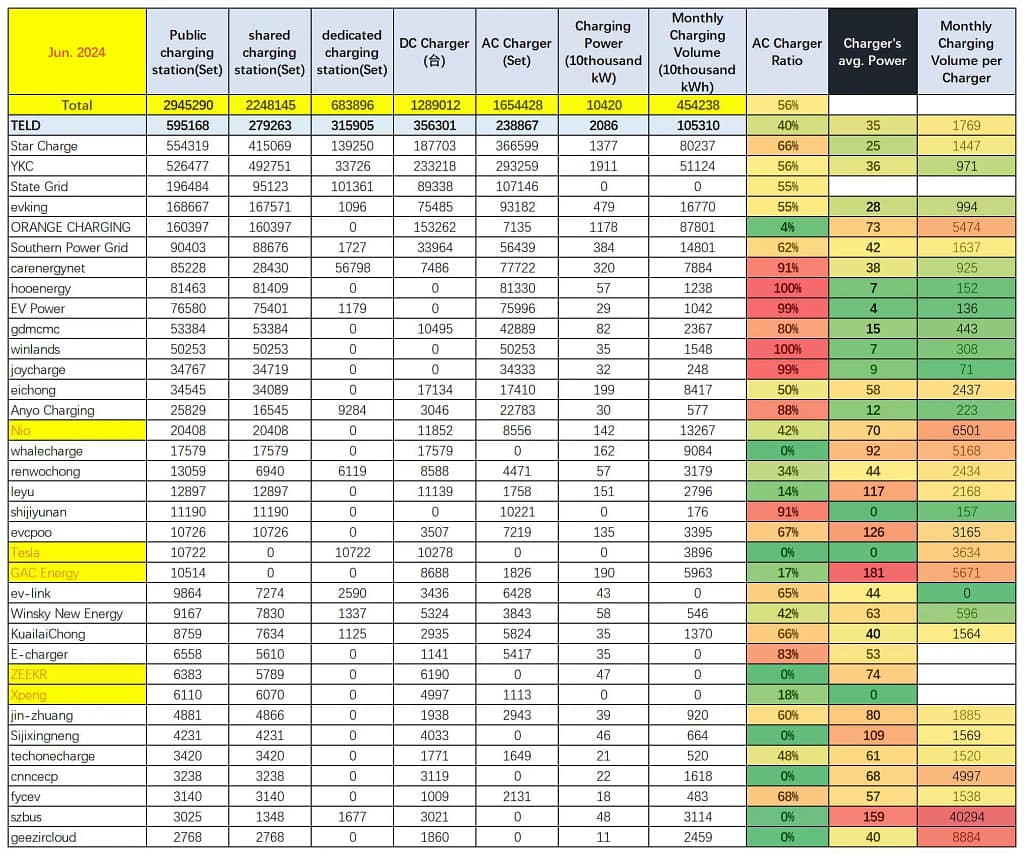

From the perspective of ev charging enterprise operations, leading operators exhibit strong performance. GAC Energy’s ev charging stations averaged 5,671 kWh in June, showing excellent performance; NIO’s ev charging stations reached about 6,500 kWh; Tesla reached 3,634 kWh last month. Conversely, some older ev charging stations averaged only around 100 kWh per month. With a focus on the rapid growth trend of new energy vehicles, particularly electric vehicles, it is essential to further construct a high-quality ev charging infrastructure system, update outdated low-power AC chargers, and increase high-power DC fast charging infrastructure upgrades. This will better meet the needs of the people for purchasing and using new energy vehicles, aiding in the promotion of green, low-carbon transportation and the construction of a modern infrastructure system.

1. General Status of EV Charging Stations

EV charging infrastructure provides essential charging and battery swap services for electric vehicles, being a crucial type of transportation energy integration infrastructure.

- In 2021, the number of public ev charging stations increased by 340,000, and home ev charging stations increased by 600,000. The annual increase in public ev charging stations decreased by 18% compared to 2020, while the increase in home charging stations decreased by 32% compared to 2020.

- In 2022, the number of public ev charging stations increased by 650,000, and home ev charging stations increased by 1.94 million. The annual increase in public ev charging stations grew by 92% compared to 2021, and the increase in home ev charging stations grew by 226% compared to 2021.

- In 2023, the number of public ev charging stations increased by 930,000, with an annual increase rate of 43% compared to 2022. Home ev charging stations increased by 2.457 million from the end of 2022, with an annual increase rate of 27% compared to 2022.

- In June 2024, the number of public ev charging stations increased by 72,300 compared to the previous month, a 12% faster growth rate compared to the same period last year. The annual cumulative increase in public ev charging stations was 400,000, achieving a 13% growth rate compared to the same period last year. Home ev charging stations accompanying vehicles increased by 247,000 compared to the previous month, a 7% faster growth rate compared to June 2023. The annual cumulative increase in home ev charging stations was 1.25 million, a 15% growth rate compared to the same period last year. The total public ev charging volume was 456,000 kWh, showing a good growth rate compared to the same period last year, with an average monthly charging volume of 1,461 kWh per station, a 6% increase compared to June last year.

According to surveys, charging generally occurs at self-owned ev charging stations, shared ev charging stations, and public ev charging stations within communities or companies, each accounting for 22%-26%, totaling around 75%. The remaining respondents charge at public ev charging stations outside the community, such as roadside stations, or at public charging stations attached to places like malls and cinemas.

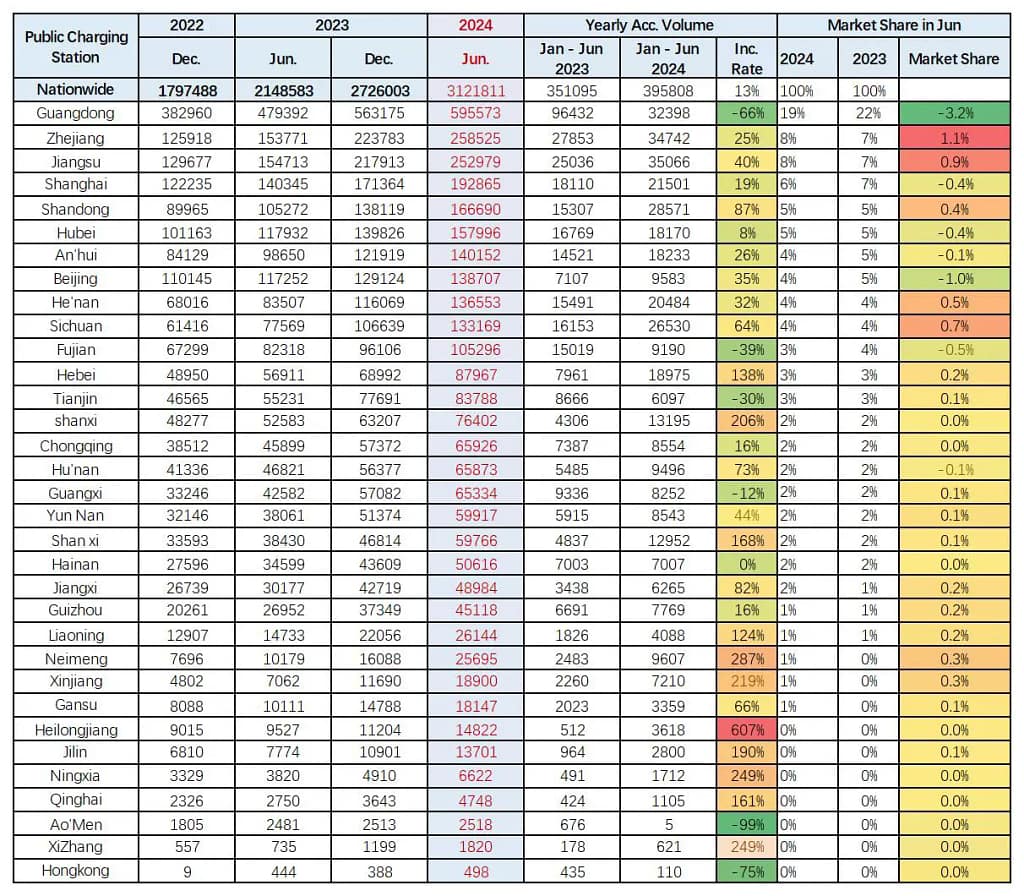

2. Analysis of Public EV Charging Station Characteristics Across Regions

From January to June 2024, the number of public ev charging stations increased by 396,000 compared to the end of 2023, with a growth rate of 13%, indicating a rapid expansion.

- Guangdong: The number of public ev charging stations increased by 32,300 in the first half of 2024, accounting for 19% of the total. However, this is a decrease from the 96,000 stations added in the first half of the previous year, which accounted for 22%.

- The scale of ev charging stations varies significantly across regions, with more developed cities having larger ev charging station networks. Guangdong, Jiangsu, Zhejiang, Shanghai, and Beijing have well-developed ev charging infrastructure.

- Shandong and Henan: Each saw an increase of about 20,000 ev charging stations in the first half of 2024, indicating a fast growth rate.

- Beijing: Currently has 139,000 public ev charging stations, with an addition of nearly 10,000 this year, showing steady growth in an already large-scale infrastructure.

- Shanghai: Exhibits a similar trend as Beijing.

Currently, the vehicle-to-public ev charging station ratio in China is significantly better than in Europe and the US, although there are issues with underutilization and significant losses for some public ev charging stations.

3. Analysis of EV Charging Enterprises Characteristics

There is a clear leading effect among operators, particularly with the development of DC charging stations.

- GAC Energy: Achieved an average charging volume of 5,671 kWh per station in June, showing excellent performance.

- NIO: Recorded an average of about 6,500 kWh per station.

- Tesla: Reached 3,634 kWh per station.

- Older charging stations: Averaged only about 100 kWh per month.

Leading ev charging enterprises achieve monthly charging volumes at the kilowatt level, with disparities in charging volumes leading to significant differences in operational efficiency. Tesla’s monthly data remains stable and impressive.

EV charging stations are classified into two types: DC (fast charging) and AC (slow charging) stations.

DC Charging Stations (Fast Charging):

- Characteristics: Larger in size, higher voltage, high power, and faster charging speed. They impose higher demands on the power grid.

- Usage: Typically found in highway service areas, bus stations, etc.

- Proportion: Less common, accounting for around 20%.

AC Charging Stations (Slow Charging):

- Characteristics: Lower unit cost, easier installation, usually privately owned.

- Usage: More widely distributed.

- Proportion: More common, exceeding 80%.

Technical Development Trends:

- DC charging stations are gradually moving towards higher power capacities.

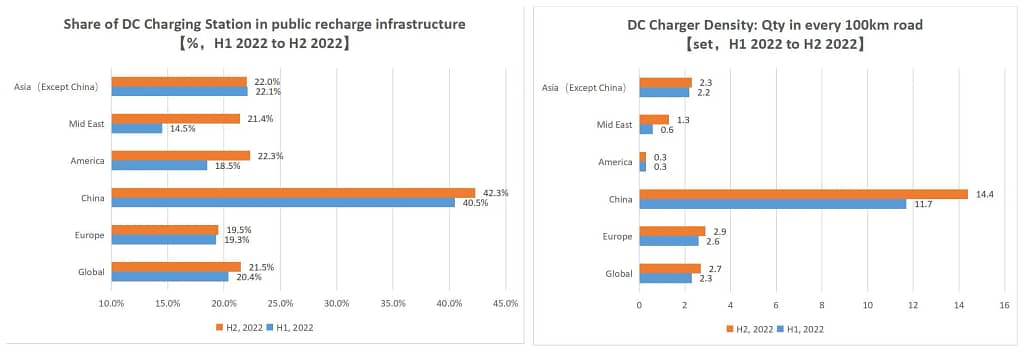

International Comparison:

- Public dedicated ev charging stations are the most efficient, especially for fixed charging needs like buses, where orderly charging is very effective.

- The number and density of public DC charging stations are increasing globally.

- China leads in promoting DC charging stations, with over 42% of the public network consisting of DC charging stations in 2024.

- The Middle East is emerging as a “rising star” in DC charging stations, with the proportion of DC charging stations increasing by 7% in 2022 to over 21%. The density of DC charging stations also grew by 125%, reaching 1.3 DC charging stations per 100 kilometers of road.

- These data points indicate a rapid growth trend that is expected to continue.

Key Points:

- DC Charging Stations: Higher efficiency, suitable for high-demand areas, significant presence in public networks.

- AC Charging Stations: Cost-effective, suitable for private and widespread use.

- Growth Trends: Increasing global focus on DC stations, with China and the Middle East showing significant advancements.

4. Analysis of Satisfaction Capability for EV Charging Station Demand

The national new energy development plan clearly states that slow ev charging at home should account for over 90% of charging needs. The slower development of home ev charging stations has severely impacted the widespread adoption of electric vehicles.

- According to surveys, users with self-owned ev charging stations report higher satisfaction in various aspects (sufficiency, rational layout, charging price, billing accuracy) compared to other respondents.

- Private ev charging stations: Provide owners with the convenience of home charging, typically installed along with the vehicle, and serve a large customer base, forming the backbone of the basic ev charging infrastructure.

From January to June 2024, domestic retail sales of Battery electric cars reached 2.42 million units, with 396,000 new public charging stations and 1.25 million new private ev charging stations.

Considering the retail scale of pure electric passenger cars and comparing the service capacity of public and private ec charging stations on a 1:1 basis, the vehicle-to-charging station ratio is 1.5:1, indicating relatively sufficient ev charging infrastructure. If we consider the 3:1 charging utilization ratio between public and private stations, the ratio reaches 0.99, essentially achieving a balanced 1:1 relationship. Due to the significant increase in public charging stations, the overall vehicle-to-charging station ratio has reached a relatively reasonable level.