Duevolt New Energy reviews the global automotive market and sales data each month. This article will cover the auto market in European countries for May. In brief, overall sales in Europe are reasonable but still lag behind compared with pre-pandemic levels, mainly due to macroeconomic influences. Notably, the sales of EVs, which are significantly affected by subsidies, have seen a sharp decline.

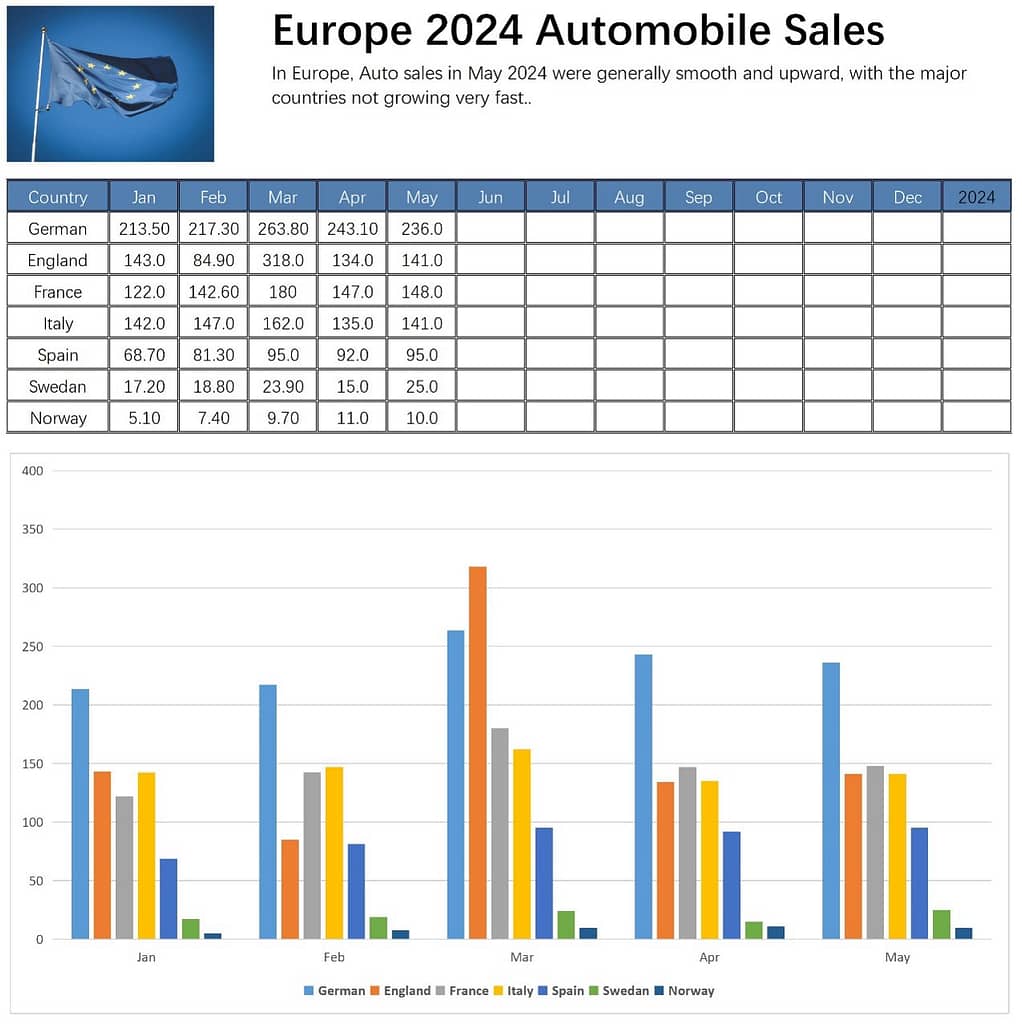

Overview of Auto Sales in European Countries

- Germany: 236,000 units

- UK: 141,000 units

- France: 148,000 units

- Italy: 141,000 units

- Spain: 95,000 units

- Sweden: 25,000 units

- Norway: 10,000 units

The major markets are not particularly promising. Although the trend from January to May shows a gradual upward movement, the sales in May was indeed not satisfying.

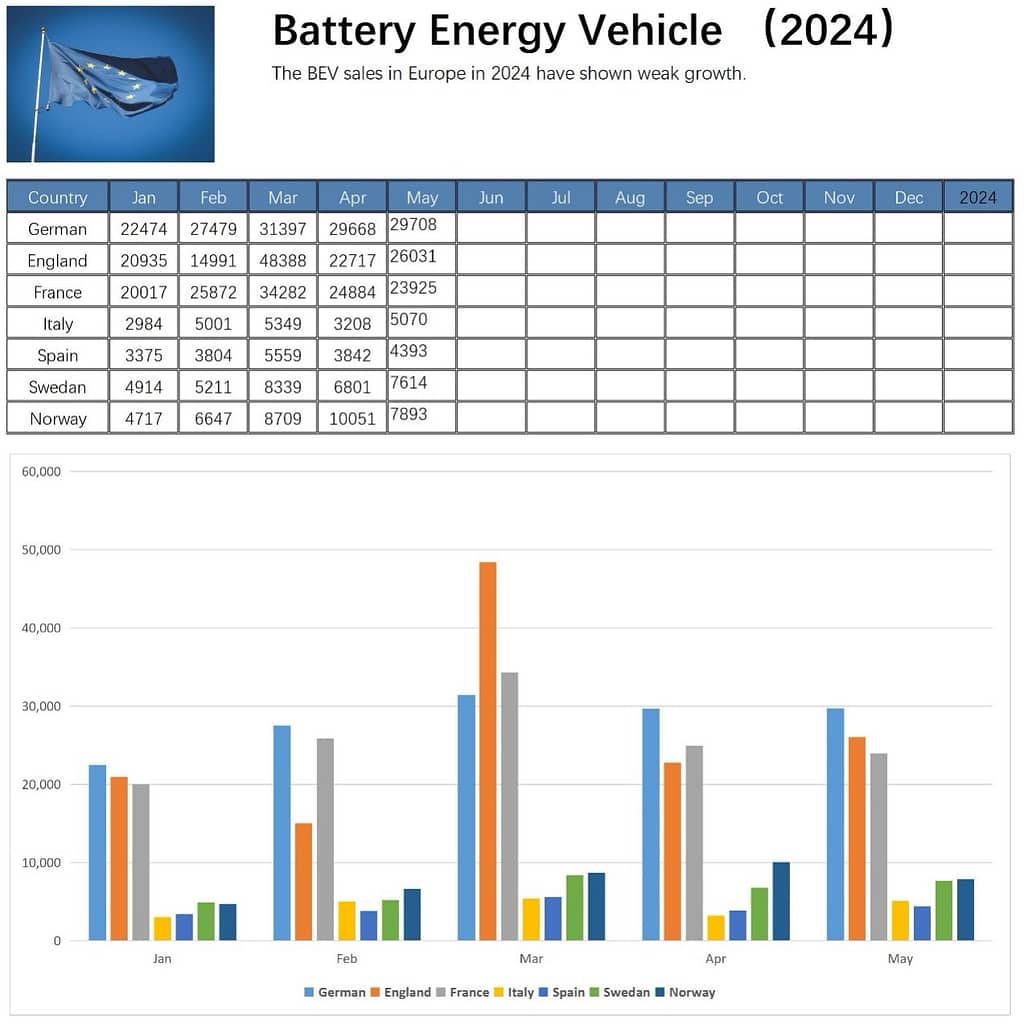

1. Sales of New Energy Vehicle in Europe in May

1.1 Europe Battery Electric Vehicle Sales in May

Currently, the three leading countries in Europe—Germany, France, and the United Kingdom—have EV sales back in the 20,000 to 30,000 range, essentially stabilizing within this range.

In contrast, other countries are all below 10,000 units, indicating that demand is indeed weak.

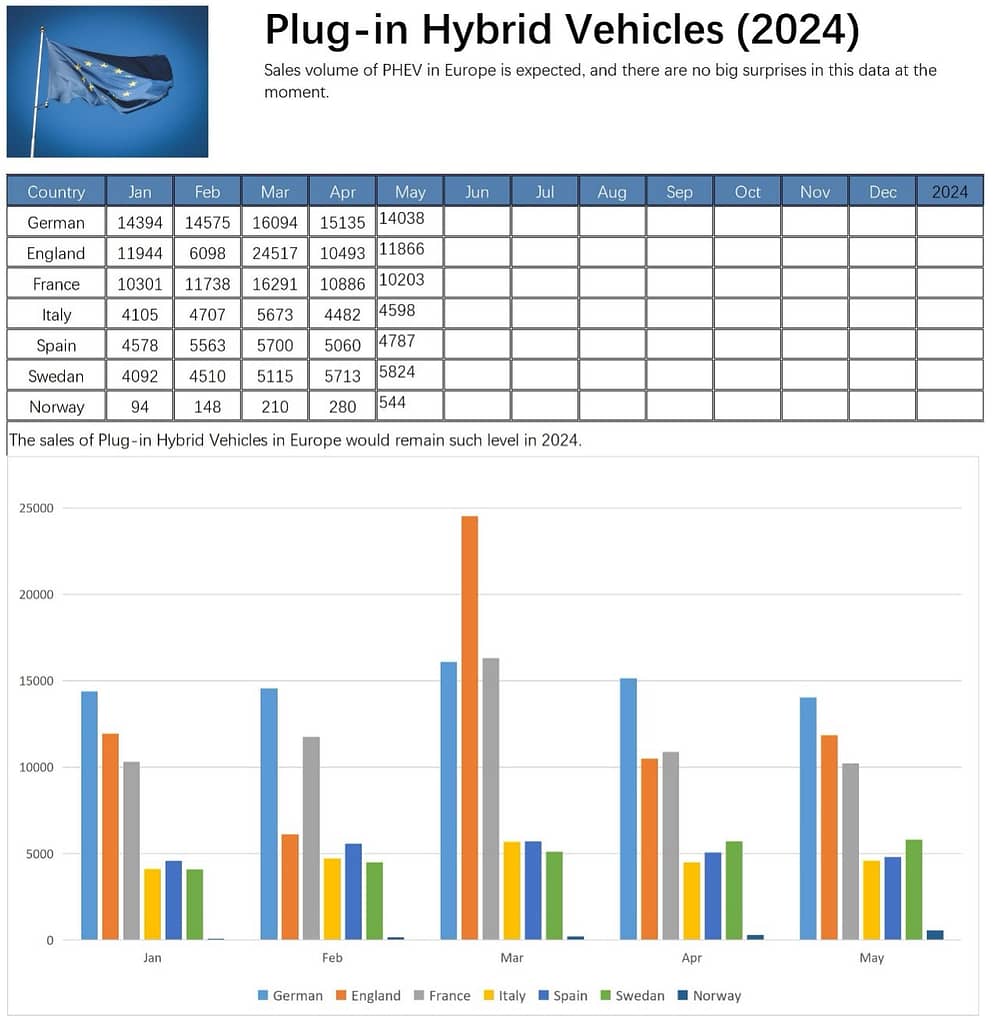

1.2 Europe Plug-in Electric Vehicle Sales in April

The situation for plug-in hybrid Electric vehicles is even worse. The leading countries in sales are only in the 10,000 to 20,000 range, while other countries are around 5,000 units. This indicates a very small market scale.

2. Overview of Major Markets: DE, FR, UK

Let’s take a closer look at the situation in the main countries one by one and analyze them.

2.1 Germany

In May, new passenger car registrations in Germany decreased by 4.3% year-on-year, reaching 236,425 units. Despite the decline in May, the cumulative sales for the first five months of 2024 still increased by 5.2% year-on-year, reaching 1,174,312 units.

2.2 France

In May 2024, the French new car market experienced its first year-on-year decline since July 2022, with sales dropping by 2.9% to 141,298 units. Compared to the pre-pandemic sales level in May 2019 (193,000 units), this sales figure remains significantly lower than the pre-pandemic level.

2.3 UK

In May, the UK EV market saw growth, with the share of plug-in vehicles rising to 25.7%, surpassing last year’s 23.1%. The main driver of this growth was plug-in hybrid vehicles, while the increase in fully electric vehicles was smaller. The overall car market showed signs of recovery, with 147,678 units sold, a 2% year-on-year increase, but still below the approximately 175,000 units level of 2020. In detail, fully electric vehicles accounted for 17.6% of total sales, and PHEV accounted for 8.0%, both up from last year’s 16.9% and 6.2%, respectively.

2.4 Norway

In May, the total car sales in Norway were 10,256 units, a year-on-year decrease of 37%.

2.5 Tesla in Europe

The situation for Tesla in European countries is challenging, leading to some confusion about whether Tesla is underperforming or if the entire market is experiencing difficulties.

- Germany: 1,896 units, down 64%.

- France: 2,197 units, down 45%.

- UK: 3,152 units, down 8%.

- Norway: 832 units, down 72%.

- Sweden: 1,086 units, down 56%.

- Italy: 1,073 units, down 27%.

The sales volume of Tesla in Europe in May reached at a low level.